Employee benefits aren’t just perks for your staff—they’re a smart tax-saving strategy for your business. By investing in benefits, you not only strengthen retention and morale but also unlock valuable deductions that reduce your company’s taxable income.

Here are some employee benefits that you may already be aware of:

- Health & Wellness – medical, dental, vision insurance; gym memberships; mental health support.

- Retirement – 401(k) plans with employer match or pension options.

- Paid Leave – vacation, sick days, parental leave, mental health days.

- Professional Development – tuition reimbursement, certifications, training stipends.

One of the most overlooked opportunities is tax-related benefits. Giving employees access to year-round tax prep and advisory support ensures they maximize their refunds and financial health—while your business enjoys the advantage of a fully deductible expense.

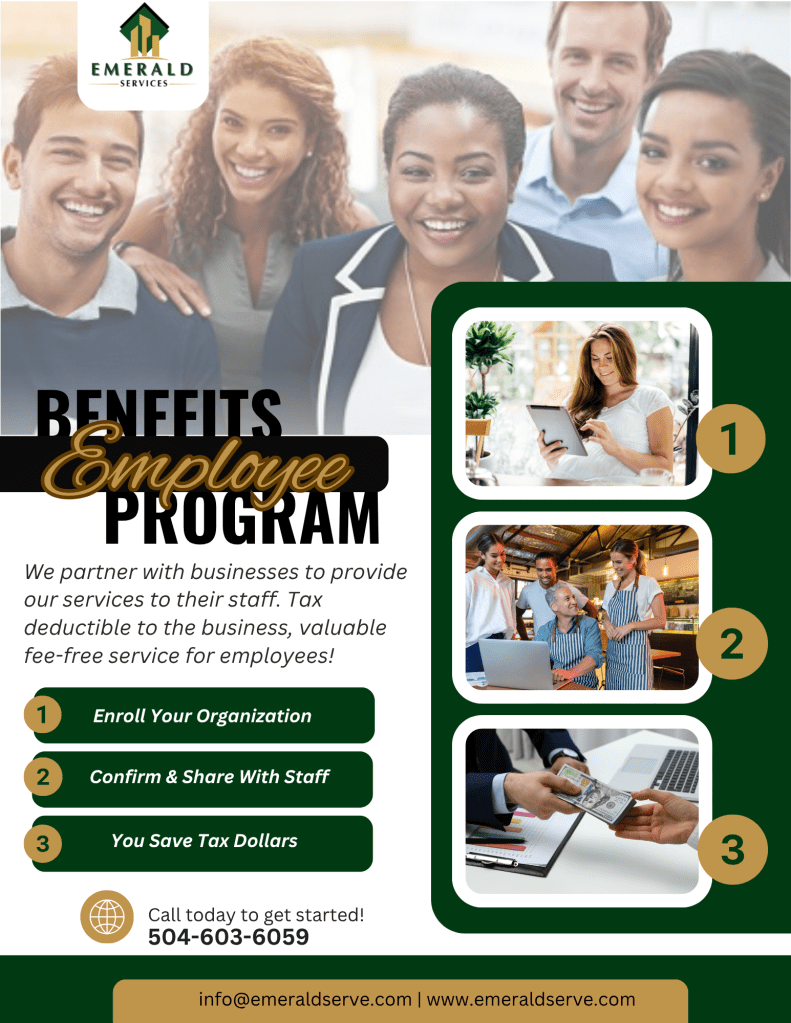

At Emerald Services, we’ve created a Tax Prep & Advisory Employee Benefit Program tailored for companies with 5 or more employees. It’s deductible for you, invaluable for your team, and ensures everyone is ready for the upcoming tax season.

Enrollment is open now—but to make the most of these savings, businesses must get started before the tax season rush.

Enrollment is open now—but to make the most of these savings, businesses must get started before the tax season rush.

Don’t wait. Secure your spot today and give your employees the benefit they’ll thank you for.

Don’t wait. Secure your spot today and give your employees the benefit they’ll thank you for.

___________________________

Next Steps:

- Email info@emeraldserve.com for a one-page overview explaining more on the program

- Schedule your Intro Call – Get a quote based on your workforce size

- Complete Enrollment